Listed IPOs GMP

Check the latest Grey Market Premium (GMP) rates for recently listed IPOs and their listing performance. Updated every 5 minutes with real-time data.

Recently Listed IPOs

No recently listed IPOs.

What is IPO GMP?

GMP stands for Grey Market Premium. It represents the premium at which IPO shares are traded in the grey market before they are officially listed on the stock exchange. The GMP is an unofficial indicator of the market sentiment and potential listing price of an IPO.

Formula: Expected Listing Price = Issue Price + GMP

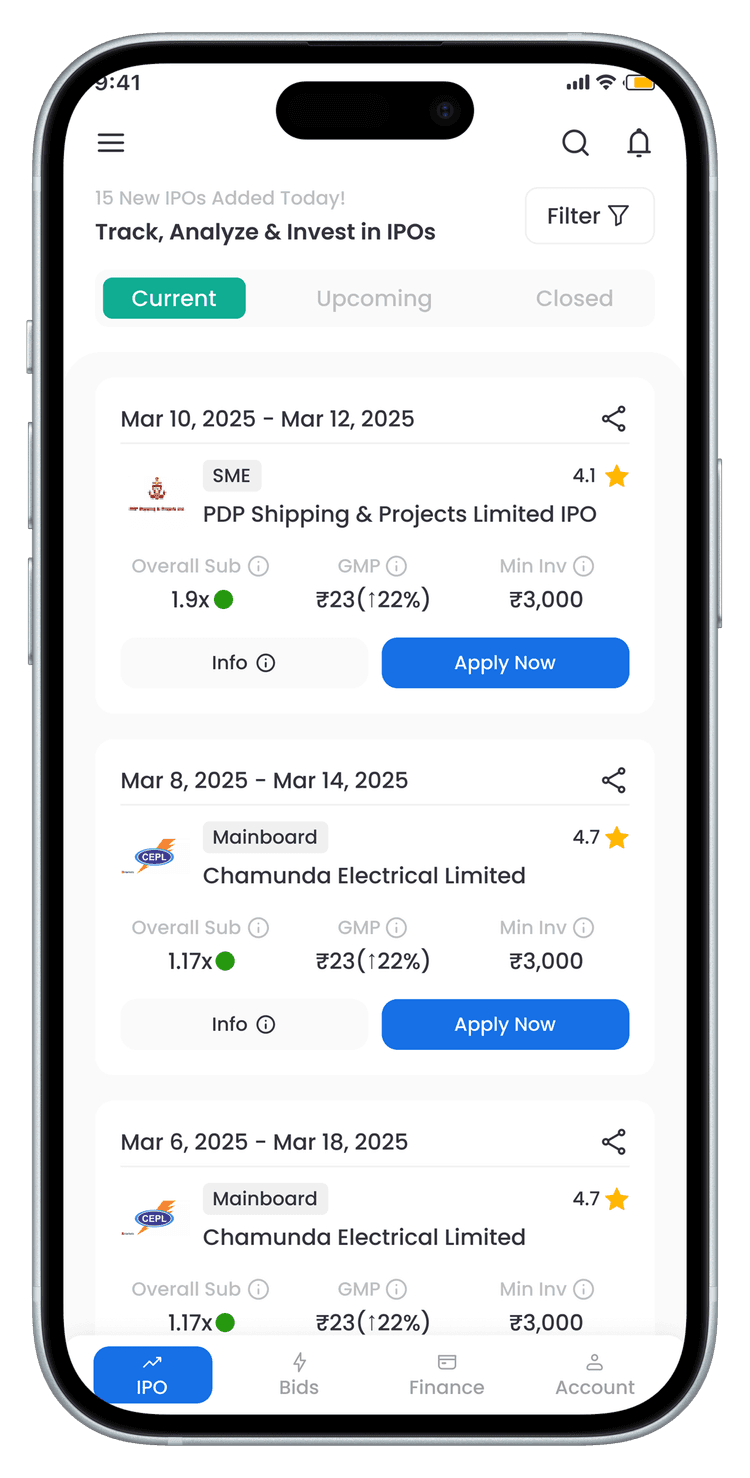

Track Listed IPOs in Real-Time

Stay updated with the latest listing gains and post-listing performance of recent IPOs. Download the Envest app for instant notifications and tracking features.

- Real-time listing gain analytics

- Compare listing performance across IPOs

- Set price alerts for newly listed stocks

Listed IPOs - Frequently Asked Questions

Why do listing gains matter for IPO investors?

Listing gains are the first-day returns that investors receive when an IPO gets listed at a premium to its issue price. These gains are important as they provide immediate returns to IPO applicants who were allocated shares. A strong listing performance often indicates market confidence in the company and can lead to further price appreciation in the short to medium term.

Can I predict listing gains based on GMP?

Grey Market Premium (GMP) can provide some indication of potential listing gains, but it's not always accurate. GMP reflects unofficial trading before listing and can fluctuate significantly based on market sentiment, subscription numbers, and external factors. While high GMP often correlates with strong listing gains, it should be used as just one of many factors in your investment decision.

When should I sell my shares after an IPO listing?

The decision to sell IPO shares depends on your investment strategy. Some investors prefer to book listing gains on the first day, while others hold for longer periods to benefit from potential long-term growth. Consider factors like the company's fundamentals, market conditions, your initial investment thesis, and your financial goals before making this decision.

How do I analyze post-listing performance of IPO stocks?

To analyze post-listing performance, track metrics like price movement compared to listing price, trading volumes, institutional buying/selling patterns, quarterly financial results, and management commentary. Compare the stock's performance with sector peers and broader market indices. The Envest app provides comprehensive tools to monitor these metrics for newly listed companies.

Track Post-Listing Performance with Envest

Get real-time alerts on price movements, expert analysis, and detailed charts for newly listed IPOs. Make informed decisions on when to hold or book profits.